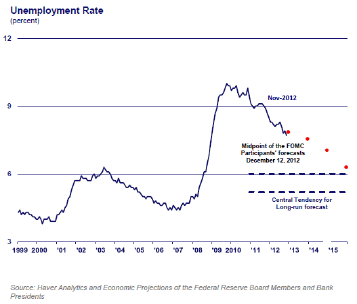

On December 12th the US Federal Open Market Committee (FOMC), announced it would keep interest rates close to zero considering that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 from its current 7.7%. [1]

Although this statement is in line with the dual mandate of the FED (price stability and full employment [2]), until recently the FOMC had been cautious not to state its policy objectives in terms of either full employment or the unemployment rate, preferring instead to state its dual mandate in terms of price stability and economic growth.[3]

Referring to economic growth or employment is not indifferent. Some economists are questioning the labour content of economic growth, as illustrated by two articles published in the same week as the FOMC decision.

A few days before this decision, Paul Krugman devoted its editorial in the New York Times to “Robots and Robber Barons”. [4] “About the robots: there’s no question that in some high profile industries, technology is displacing workers of all, or almost all, kinds”. To substantiate his point, he notes that in a recent book, “Race Against the Machine”, M.I.T.’s Erik Brynjolfsson and Andrew McAfee argue that similar stories are playing out in many fields, including services like translation and legal research. “What is striking about their examples is that many of the jobs being displaced are high-skill and high-wage; the downside of technology isn’t limited to menial workers.”

Commenting the decision of the FOMC, Gillian Tett, markets and finance commentator of the Financial Times, uses a title that is even more explicit: “Digital threat to Fed’s jobless target”.[5] The argument relies on some anecdotic evidence. “In recent months, something striking has quietly occurred at Exim Bank, the US export credit guarantee agency. For the fourth year in a row, the agency is watching an export boom. So far this year, Exim has provided $35.8bn of export financing to support $50bn of export sales, 25 per cent up on last year. But while that might seem good news for the American economy, there is a crucial catch: so far in 2012, the number of jobs backing those Exim-supported exports has fallen by 12 per cent.” She notes that “to make sense of the trend, you need to look at digitisation, or the growing tendency of businesses to use computers, not simply to perform self-standing economic functions, but to communicate with each other via barcodes, and other digital networks.”

As Paul Krugman, Gillian Tett also refers to a recent publication to strengthen her point, more precisely to Brian Arthur, an academic at the Palo Alto Research Centre, who argues that since digitisation first started in 1995 it has exploded exponentially, performing an ever-greater proportion of economic functions. Indeed, he suggests that digital network accounts for 60-80 per cent of productivity gains.

According to Brian Arthur, “Digitization is creating a second economy that is vast, automatic, and invisible— thereby bringing the biggest change since the Industrial Revolution. (…) The second economy will certainly be the engine of growth and the provider of prosperity for the rest of this century and beyond, but it may not provide jobs, so there may be prosperity without full access for many. This suggests to me that the main challenge of the economy is shifting from producing prosperity to distributing prosperity.” [6]

Oops! This is what my post “ICT, Panem et Circensem”is about (when pushing robots to the limits of absurdity).

The be real, the second economy must increase labour productivity in a very significant way. Actually, US labour productivity growth (value added per hour – business sector) is on a downwards trend (1995-2009). Between 1995 and 2009, the share of ICT (IT equipment + CT equipment + software) in explaining labour productivity was between 25 and 20 %. This contribution declined with respect to the contribution in 1995-2001.

Source: Massimiliano Iommi, Italian Statistical Institute (ISTAT) and Luiss Lab of European Economics (LLEE)

Data: EU KLEMS (http://www.euklems.net), COINVEST and INNODRIVE (http://www.intan-invest.net), and ongoing effort of The Conference Board (http://www.conference-board.org/)

These data are adding weight to Robert Gordon’s argument that ICT created only a short-lived growth revival.

As pointed out more recently by Paul Krugman, “the case against Mr. Gordon’s techno-pessimism rests largely on the assertion that the big payoff to information technology, which is just getting started, will come from the rise of smart machines. Therefore, machines may soon be ready to perform many tasks that currently require large amounts of human labor. This will mean rapid productivity growth and, therefore, high overall economic growth” (Is Growth Over ? New York times, December 27, 2012).

I’m looking forward to reading the AEA proceedings (see my previous post: The Economics of ICT and the Forthcoming American Economic Association Meeting).

[1] Federal Reserve, http://www.federalreserve.gov/newsevents/press/monetary/20121212a.htm

[2] The Full Employment and Balanced Growth Act of 1978, more commonly known as the Humphrey-Hawkins Act (henceforth, HH), established price stability and full employment as national economic policy objectives.

[3] Daniel L. Thornton, The Dual Mandate : Has the Fed Changed Its Objectives, Fed of St. Louis, March/April 2012

[4] Paul Krugman, Robots and Robber Barons, Published: December 9, 2012 http://www.nytimes.com/2012/12/10/opinion/krugman-robots-and-robber-barons.html?_r=0

[5] Financial Times, December 13,, 2012

http://www.ft.com/intl/cms/s/0/b4c6d936-4532-11e2-838f-00144feabdc0.html#axzz2FTNce0Ad

[6] W. Brian Arthur, The Second Economy, McKinsey Quarterly, October 2011 http://www.curtin.edu.au/research/local/docs/The_Second_Economy.pdf